Stimulus Check 2025 – Key Payment Dates

Imagine checking your bank account and finding an unexpected deposit labeled “stimulus payment.” For many Americans, this was a lifeline during the pandemic. But what about 2025? Are Stimulus Check 2025 still a reality? With rising costs for groceries, gas, and rent, the question of stimulus check 2025 payment dates is on everyone’s mind.

This article is your comprehensive guide to understanding what’s available in 2025. From unclaimed federal Recovery Rebate Credits to state-level relief programs and the speculative DOGE dividend, we’ll cover payment dates, eligibility, and how to claim your funds. Whether you’re a taxpayer catching up on past credits or hoping for new relief, we’ve got you covered with clear, up-to-date information. Let’s dive in!

Background on Stimulus Checks

History of Stimulus Payments

Stimulus checks, officially called Economic Impact Payments (EIPs), were a cornerstone of pandemic relief. The federal government issued three rounds:

-

March 2020 (CARES Act): Up to $1,200 per adult and $500 per child under 17.

-

December 2020 (COVID-related Tax Relief Act): Up to $600 per adult and child.

-

March 2021 (American Rescue Plan): Up to $1,400 per adult and dependent, including adult dependents.

These payments, totaling over $814 billion, helped millions cover essentials. If you missed any, the Recovery Rebate Credit allowed you to claim them on your 2020 or 2021 tax returns. While most eligible taxpayers received their funds, some overlooked claiming the 2021 credit, leading to recent IRS action.

Why Stimulus Check 2025 Matter in 2025

Economic relief remains critical in 2025. Inflation has driven up costs for housing, food, and energy, squeezing household budgets. Stimulus Check 2025, whether federal or state, provide immediate relief and boost local economies by encouraging spending. For low- and middle-income families, these payments can mean paying off debt, covering utilities, or affording school supplies. As we explore Stimulus Check 2025, you’ll see how they continue to address economic relief 2025.

Read More About: $1400 Stimulus Check 2025 – Claim Now with This Powerful Guide

Federal Stimulus Check 2025 – What’s Available?

Unclaimed 2021 Recovery Rebate Credit

The IRS recently made headlines by issuing $2.4 billion in automatic payments to 1 million taxpayers who didn’t claim the 2021 Recovery Rebate Credit. This credit applies to those who missed the third EIP of up to $1,400 per person. If you filed a 2021 tax return but left the credit field blank or entered $0, you may have received a payment in December 2024 or January 2025.

For those who didn’t file a 2021 return, there’s still hope—but time is up. The deadline to file and claim this credit was April 15, 2025. If you missed it, unclaimed funds revert to the U.S. Treasury. Eligibility includes:

-

Adjusted Gross Income (AGI) under $75,000 (single) or $150,000 (joint).

-

Valid Social Security Number (SSN).

-

Not claimed as a dependent.

Check your IRS online account to confirm your payment status.

Payment Dates for Unclaimed Stimulus

The IRS began issuing automatic Recovery Rebate Credit payments in December 2024. Most were delivered by late January 2025 via:

-

Direct deposit: To the bank account listed on your 2023 tax return.

-

Paper check: Mailed to your address of record.

If your bank account closed, the IRS reissued payments by mail. Taxpayers received a notification letter confirming the payment. No new federal IRS stimulus payments are confirmed for 2025, so these were the last of the pandemic-era relief. Use the IRS’s “Get My Payment” tool or call 800-829-1954 to track your status.

Speculation on New Federal Stimulus

Rumors of a fourth Stimulus Check 2025—$1,000, $1,600, or $2,000—have swirled online, but no official confirmation exists from Congress or the IRS. These claims often stem from misinformation or scams. Always verify information on IRS.gov. Posts on X have fueled speculation, but they lack credible backing.

For example, a viral claim about a $1,338 Stimulus Check 2025 was debunked as fraudulent. Protect yourself by avoiding unofficial websites promising 2025 Stimulus Check 2025. Stick to trusted sources for updates.

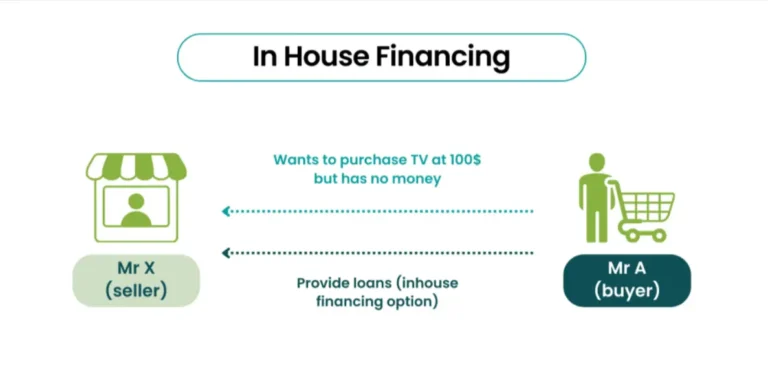

DOGE Stimulus Check 2025 Proposal

What Is the DOGE Dividend?

The Department of Government Efficiency (DOGE), led by Elon Musk under the Trump administration, proposed a $5,000 “DOGE dividend” to return federal savings to taxpayers. Announced in February 2025, the plan aimed to distribute 20% of DOGE’s cost-cutting savings—initially estimated at $2 trillion.

However, as of June 2025, the proposal remains speculative. DOGE claims $130–$175 billion in savings, far short of the $2 trillion needed for $5,000 checks. Musk’s departure from DOGE in May 2025 further clouds its future.

Feasibility and Payment Dates

The DOGE dividend faces significant hurdles:

-

Funding: $130 billion translates to roughly $807 per taxpayer, not $5,000.

-

Congressional Approval: No legislation has been passed.

-

Economic Risks: Economists warn that borrowing to fund checks could spike inflation and deepen the national debt.

No DOGE Stimulus Check 2025 payment dates are confirmed for 2025. Experts advise against relying on this unverified plan. Monitor IRS.gov or Treasury.gov for updates.

State-Level Stimulus Programs in 2025

Overview of State Relief Efforts

With federal stimulus uncertain, states are stepping up. Budget surpluses from strong economies and oil revenues have enabled programs in states like California, Oregon, and Alaska. These state stimulus programs target inflation relief, offering payments to residents based on income, residency, or tax filing status. Below, we detail key programs and their Stimulus Check 2025 payment dates.

Specific State Programs and Payment Dates

-

California: The Sacramento Family First program provides $725 monthly payments to 200 low-income families through November 2025. A broader relief program offers up to $725 for eligible households, mailed from April to June 2025. Check the California Franchise Tax Board for details.

-

Oregon: Low- and middle-income residents receive $200–$600 rebates, distributed through mid-June 2025. Payments prioritize direct deposit.

-

Minnesota: A $1,000 rebate program, funded by a budget surplus, continues through June 2025. Direct deposits are fastest.

-

Alaska: The 2025 Permanent Fund Dividend pays $1,702 to eligible residents, typically issued from October to December.

-

Colorado: TABOR refunds from a $1.5 billion surplus offer up to $565 (single) or $1,130 (joint), expected in summer 2025.

-

New York (Proposed): Governor Hochul’s $3 billion Inflation Refund could send $300 (single) or $500 (joint) to taxpayers in 2025, pending approval.

Other states like Virginia and New Mexico are exploring similar rebates.

How to Check State Payment Status

Track your state payment through official revenue department websites:

-

California: Franchise Tax Board (ftb.ca.gov).

-

Oregon: Department of Revenue (oregon.gov/dor).

-

Minnesota: Department of Revenue (revenue.state.mn.us).

Most portals require your SSN, filing status, and refund amount. Update your contact information to avoid delays.

Eligibility and How to Claim Stimulus Payments

Federal Eligibility Criteria

To qualify for the 2021 Recovery Rebate Credit, you needed:

-

AGI below $75,000 (single) or $150,000 (joint) for the full $1,400.

-

A valid SSN.

-

Not be claimed as a dependent.

The April 15, 2025, deadline has passed, so no new claims are possible. For future stimulus eligibility, monitor IRS.gov.

State Eligibility Criteria

State programs vary but often require:

-

State residency.

-

Filed tax returns (e.g., 2023 or 2024).

-

Income below specific thresholds (e.g., $150,000 in California).

For example, Alaska’s Permanent Fund Dividend requires one year of residency. Check your state’s revenue website for details.

Steps to Claim or Track Payments

-

Federal: Create an IRS online account to view payment history. If you missed the April 2025 deadline, contact the IRS at 800-829-1954 for guidance.

-

State: Use state portals or contact revenue departments. Ensure your bank details are updated for direct deposits.

Act quickly to avoid missing state deadlines.

Tips to Avoid Stimulus Check 2025 Scams

Common Scams in 2025

Scammers exploit stimulus hype with:

-

Phishing emails posing as the IRS.

-

Fake calls demanding bank details.

-

Websites promising unverified checks (e.g., $1,338 or $2,000).

These scams steal personal information or money.

How to Stay Safe

-

Verify information only on IRS.gov or state government sites.

-

Never share SSNs or bank details via unsolicited calls or emails.

-

Report scams to the IRS or Federal Trade Commission (ftc.gov).

Protecting yourself ensures you safely access IRS stimulus payments.

Stimulus Check 2025 offer hope amid economic challenges. While federal stimulus check 2025 payment dates for the Recovery Rebate Credit have passed, state programs in California, Oregon, and beyond provide timely relief through June and beyond. The DOGE dividend remains a long shot, but staying informed keeps you prepared.

Take action now: check state portals, update your details, and file taxes promptly for future Stimulus Check 2025. Visit IRS.gov and your state’s revenue site for the latest updates. With proactive steps, you can secure the economic relief 2025 you deserve.

FAQs – Stimulus Check 2025 Payment Dates

1. Can non-residents qualify for state Stimulus Check 2025?

Most state stimulus programs, like those in California and Oregon, require state residency for at least one year. Non-residents, even if they work in the state, typically don’t qualify. Check your state’s revenue department website to confirm residency rules.

2. What happens if I moved states after receiving a stimulus payment?

If you received a federal or state payment and then moved, you don’t need to return it. However, update your address with the IRS or state revenue department to ensure future correspondence or payments reach you.

3. Are Stimulus Check 2025 taxable in 2025?

Federal stimulus payments, like the Recovery Rebate Credit, are not taxable. Most state payments, such as California’s $725 rebate, are also tax-free, but check state-specific rules, as some may count as taxable income.

4. Can I claim a Stimulus Check 2025 for a deceased relative in 2025?

No. The IRS does not issue stimulus payments for deceased individuals. If a payment was sent in error, you may need to return it. Contact the IRS at 800-829-1954 for guidance.

5. How do Stimulus Check 2025 affect my 2025 tax refund?

Federal stimulus payments, including Recovery Rebate Credits, don’t reduce your 2025 tax refund. State payments may impact state tax calculations in rare cases, so consult a tax professional.

6. Are there stimulus programs for small businesses in 2025?

While not traditional Stimulus Check 2025 , some states offer grants or tax credits for small businesses. For example, California’s Small Business Relief Grant provides up to $25,000. Check state economic development websites.

7. Can I receive a Stimulus Check 2025 if I’m unemployed in 2025?

Yes, unemployment doesn’t affect eligibility for federal or state stimulus payments. Income thresholds and residency are the main criteria. Verify with your state’s revenue department.

8. What role do local governments play in 2025 stimulus programs?

Some cities, like Sacramento with its Family First program, fund local stimulus initiatives. These are often pilot programs for low-income households. Contact your city hall for local opportunities.

9. How do I know if my bank rejected a stimulus payment?

If your bank account was closed or invalid, the IRS or state will mail a paper check to your address of record. Check your IRS online account or state portal for status updates.

10. Are there international examples of stimulus programs in 2025?

Countries like Canada and Australia have similar relief programs. For instance, Canada’s GST Credit provides quarterly payments to low-income residents. While not directly relevant, these examples show global trends in economic relief.