House in Rent by Owner – Save More By Renting Direct

Imagine scrolling through rental listings late at night, dreaming of your next home. You spot a cozy house with a big backyard, listed as house in rent by owner. It’s cheaper than others, but you pause what does renting directly from an owner really mean? Is it a hidden gem or a potential headache?

Renting a house directly from an owner is increasingly popular in today’s tight housing market. With 34.3% of U.S. households renting in 2023 (U.S. Census Bureau), many are turning to private landlords for affordability and flexibility. This article dives deep into the world of house in rent by owner, exploring benefits, challenges, and practical tips to help you navigate this option confidently. Whether you’re a first-time renter or a seasoned tenant, the’ll arm you with insights from recent trends, environmental studies, and housing data to make your rental journey smoother.

Understanding House in Rent by Owner

What Does House in Rent by Owner Mean?

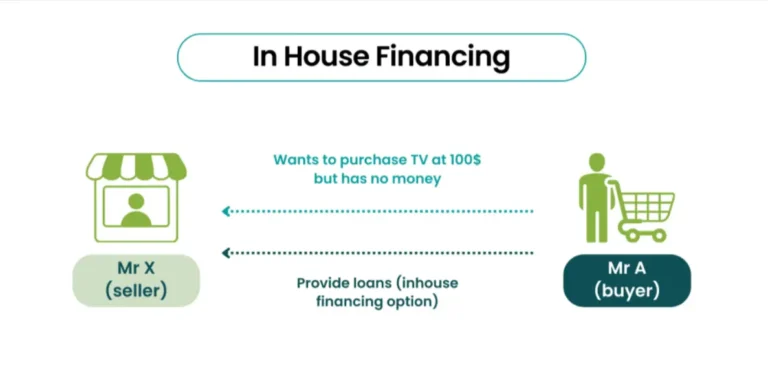

A “house in rent by owner” is a landlord renting directly by the property owner, not through a property management company. These rentals are often single-family homes (66% of single-property landlord rentals, per HUD), but they can also be duplexes, condos, or townhouses. Unlike corporate-managed apartments, you’re dealing directly with the person who owns the property.

This setup cuts out the middleman, which can mean lower costs or more personal interactions. For renters, it’s a chance to engage directly with someone who has a stake in the home’s condition. For owners, it’s about control and savings.

Why Owners Choose to Renting Directly

Why skip a property manager? Money’s a big driver. Management companies charge 8-12% of monthly rent, so owners keep more by handling rentals themselves. They also get to choose tenants and oversee maintenance, ensuring their property stays in good hands.

A 2023 Zillow survey found that most landlords renting single-family homes prefer direct management. They value picking tenants who fit their vision for the property, whether it’s a family for a long-term lease or a professional needing a short-term stay.

The Growing Popularity of Private Landlord Rentals

Renting is booming. Nearly 44 million U.S. housing units are renter-occupied, with many managed by individual owners (Harvard Joint Center for Housing Studies, 2023). High homeownership costs—driven by soaring prices and interest rates—keep renters in the market. Since the 2007-09 financial crisis, renting has surged, especially among younger adults and families.

Private landlords fill a gap, offering homes that feel more personal than cookie-cutter apartments. But what makes renting directly from an owner so appealing? Let’s explore the benefits.

Must Read About: 5StarsStocks.com – Smart Investing Tips You Need for 2025

Benefits of Renting a House Directly from an Owner

Potential Cost Savings

Renting a house from an owner can save you money. Without management fees, landlords may offer lower rent. In some markets, renters in owner-managed units pay 25-50% less than in corporate rentals, especially in rent-controlled areas (Urban Institute, 2022).

Lease terms can also be flexible. While 59.6% of rentals have 12-month leases (U.S. Census, 2023), owners might agree to six months or even month-to-month, saving you from long commitments.

Personalized Landlord-Tenant Relationship

Dealing directly with an owner means direct communication. Need a repair? You text or call the landlord, not a faceless company. This can lead to faster fixes and a stronger relationship. Owners often prioritize long-term tenants, fostering trust.

During COVID-19, small landlords in Washington, D.C., worked closely with tenants to navigate payment challenges, keeping eviction rates lower than corporate properties (D.C. Policy Center, 2021). A personal touch can make renting feel less transactional.

Flexibility in Negotiations

Owners have more wiggle room than corporations. Want to bring a pet? Paint a room? Discuss a rent-to-own option? Private landlords are often open to these talks. Unlike big companies with rigid policies, an owner might say yes to a dog or let you plant a garden.

This flexibility shines in unique situations. For example, a landlord might lower rent if you agree to handle lawn care, saving both parties time and money.

Environmental and Health Benefits

A well-maintained home is healthier. Private landlords, especially those living nearby, often address issues like mold or pests quickly—43% of renters worry about housing health impacts (American Housing Survey, 2023). A responsive owner can mean fewer headaches and a safer home.

Some landlords also invest in energy-efficient upgrades, like new HVAC systems or insulation, to cut utility costs. A 2020 environmental study found that energy-efficient rentals reduce tenant bills by up to 20% while lowering carbon footprints (Energy Policy Journal). Renting directly from an owner who cares about their property can align with your health and eco-conscious goals.

Challenges of Renting from a Private Landlord

Limited Legal Protections

Private landlords don’t always follow the strict rules corporate managers do. Without standardized processes, you might face unclear lease terms or unexpected rent hikes. Only 18% of renters feel confident their landlord will address health concerns promptly (National Low Income Housing Coalition, 2023).

Understanding tenant rights is crucial. Local laws, like eviction protections or rent control, vary widely. For example, California’s Tenant Protection Act caps rent increases, but not all landlords comply without tenant advocacy.

Inconsistent Maintenance and Quality

Not all landlords are diligent. Some cut corners, leading to issues like leaky pipes or rodent problems, especially in low-income rentals. Poor housing conditions are linked to health issues, including asthma and stress (CDC, 2022).

Before signing a lease, inspect the property closely. A landlord’s maintenance track record can make or break your experience.

Potential for Bias or Discrimination

Sadly, bias exists in renting. Studies show landlords in communities of color may enforce stricter rules or neglect upkeep (Urban Institute, 2023). Renters of color are also more likely to face application rejections, even with strong credit.

Protect yourself by documenting all communications and knowing your rights under the Fair Housing Act. If you suspect discrimination, contact a local housing authority or legal aid group.

Financial Instability of Landlords

Small landlords aren’t immune to financial struggles. During COVID-19, many sold properties due to unpaid rent, shrinking rental options (Harvard JCHS, 2023). High interest rates in 2023 also slowed multifamily construction, tightening the market further.

If your landlord faces foreclosure or sells the property, your lease could be at risk. Check the landlord’s stability by researching property records or asking about their long-term plans.

How to Find a House in Rent by Owner

Online Platforms and Resources

Start your search online. Sites like Zillow, Craigslist, and Apartments.com list “for rent by owner” properties. Be cautious—asking rents on listings are often higher than final agreements (USC Price Center, 2023). Compare multiple platforms to gauge fair pricing.

Social media is another goldmine. Facebook Marketplace and local community groups often feature unlisted rentals. These can be gems, as owners may prioritize tenants they connect with personally.

Networking and Word-of-Mouth

Don’t underestimate personal connections. Tell friends, coworkers, or neighbors you’re looking. Local real estate agents may know of unlisted owner-managed rentals, too.

Word-of-mouth builds trust. A landlord might favor a tenant referred by someone they know, giving you an edge over strangers.

Evaluating Listings

Scams are real. If a deal seems too good to be true—like rent far below market rates—it probably is. Verify the landlord’s identity through property records or a title search. Never send money without seeing the home in person.

Look for red flags: vague lease terms, no written contract, or pressure to sign quickly. A legitimate landlord will provide clear details and time to decide.

Tips for Renting a House from an Owner

Understanding Rental Agreements

A lease is your safety net. It should outline rent, lease duration, maintenance duties, and termination rules. Verbal agreements are risky—always get it in writing.

Review the lease carefully. Does it cover who handles repairs? What’s the late rent policy? Clarity prevents disputes later.

Negotiating with Private Landlords

Negotiation is an art. Propose a longer lease for lower rent or offer to handle minor upkeep, like gardening. Data shows 29.9% of leases are 24 months, proving owners value stability (U.S. Census, 2023).

Be polite but firm. If the rent’s high, show market comparisons to justify a lower rate. A win-win deal benefits both sides.

Ensuring Housing Quality and Safety

Do a thorough walkthrough before signing. Check for leaks, pests, or faulty wiring. Ask about recent upgrades—new windows or HVAC systems can save on bills.

If issues arise, reference environmental studies to push for fixes. For example, poor ventilation can worsen allergies, a concern for 30% of renters (EPA, 2022).

Knowing Your Tenant Rights

Knowledge is power. Research local laws on rent control, eviction rules, and safety standards. Resources like HUD.gov or tenant advocacy groups offer free guidance.

If a landlord violates your rights, document everything—emails, texts, and photos. This strengthens your case if you need to escalate to a housing authority.

The Bigger Picture: Trends in the Rental Housing Market

The rental market is tough. Half of U.S. renters were cost-burdened in 2022, spending over 30% of income on rent (Harvard JCHS, 2023). A shortage of 7.3 million affordable homes persists, worsened by slowed construction (National Low Income Housing Coalition, 2021).

Environmental concerns are rising, too. Renters want energy-efficient homes to cut costs and emissions. Meanwhile, debates over rent control and tenant protections shape local policies, impacting what house in rent by owner means in your area.

Renting a house directly from an owner offers unique perks—lower costs, flexibility, and a personal touch. But it’s not without risks, from inconsistent maintenance to legal gaps. By understanding the process, researching thoroughly, and advocating for your needs, you can turn a house in rent by owner into your ideal home.

The rental market is evolving, with private landlords playing a key role in affordability. Arm yourself with knowledge, negotiate smartly, and dive into your search with confidence. Your dream rental is out there—go find it!

FAQs – Renting a House by Owner

Below are 10 unique frequently asked questions (FAQs) related to renting a house directly from an owner, designed to complement the article “House in Rent by Owner” without repeating its content. These FAQs address additional renter concerns and provide fresh insights to enhance understanding.

1. How can I verify if the person listing a “house in rent by owner” is the actual property owner?

To confirm ownership, request a copy of the property deed or check public records through your county’s assessor’s office website. You can also use online tools like PropertyShark or ask for utility bills in the landlord’s name to ensure they’re legitimate.

2. Are there tax benefits for tenants renting directly from a private landlord?

Tenants typically don’t receive tax benefits for renting, whether from a private landlord or a company. However, in some states, renters may qualify for a renter’s tax credit if they meet income thresholds. Check with your state’s tax authority for details.

3. Can I sublease a house rented directly from an owner?

Subleasing depends on the lease terms. Private landlords may allow it with written permission, but some prohibit it to maintain control over tenants. Always discuss subleasing upfront and get any agreement in writing to avoid legal issues.

4. What should I do if the landlord refuses to return my security deposit?

If a private landlord withholds your deposit unfairly, request an itemized list of deductions. If they don’t comply, review your lease and local laws—most states require landlords to return deposits within 14-30 days. You may need to file a claim in small claims court.

5. How does renting from an owner affect my credit score?

Renting from a private landlord usually doesn’t impact your credit score unless they report payments to credit bureaus, which is rare. However, late payments leading to eviction or debt collection could harm your credit. Consider services like RentReporters to build credit through rent payments.

6. Can I request eco-friendly upgrades in a house rented by an owner?

Yes, you can propose upgrades like low-flow fixtures or solar panels, especially if you offer to share costs or highlight long-term savings. Private landlords may be open to these, particularly if they align with local green incentives, but it’s not guaranteed.

7. What happens if the owner decides to move back into the house during my lease?

Most leases protect your right to stay until the term ends, unless the lease includes an “owner move-in” clause. Check local laws—some areas, like San Francisco, allow evictions for owner occupancy but require notice and compensation. Always review your lease carefully.

8. Are private landlords required to provide renters insurance?

No, landlords aren’t required to provide renters insurance; it’s typically the tenant’s responsibility. Private landlords may require you to purchase a policy to protect your belongings and cover liability. Shop around for affordable plans, starting at $10-20/month.

9. How can I handle disputes with a private landlord without a property manager?

Resolve disputes through clear communication—document all issues via email or text. If unresolved, contact a local tenant advocacy group or mediator. Some cities offer free mediation services to avoid costly legal battles. Know your rights under state landlord-tenant laws.

10. Can I negotiate rent increases with a private landlord?

Yes, private landlords are often open to negotiating rent increases, especially if you’re a reliable tenant. Offer to sign a longer lease or highlight market rates to keep increases low. Approach the conversation professionally and provide evidence to support your case.