In House Financing – Flexible Payment Plans Made Simple

Imagine you’ve found the perfect car, but your credit score is less than stellar, and banks keep turning you down for a loan. Frustrating, right? Now picture the dealership offering you a payment plan directly—no bank involved. That’s in house financing, a game-changer for buyers and businesses alike.

in house financing lets sellers provide loans directly to customers, bypassing traditional lenders like banks or credit unions. It’s gaining traction in industries like automotive, real estate, and even green technology due to its flexibility and accessibility. Whether you’re a consumer with bad credit or a business looking to boost sales, this financing model has something to offer.

This article dives deep into what in house financing is, its benefits, risks, and real-world applications. We’ll also share practical tips to help you navigate this option wisely. Let’s explore how in house financing can open doors—and what to watch out for.

Understanding In House Financing

What Is In House Financing?

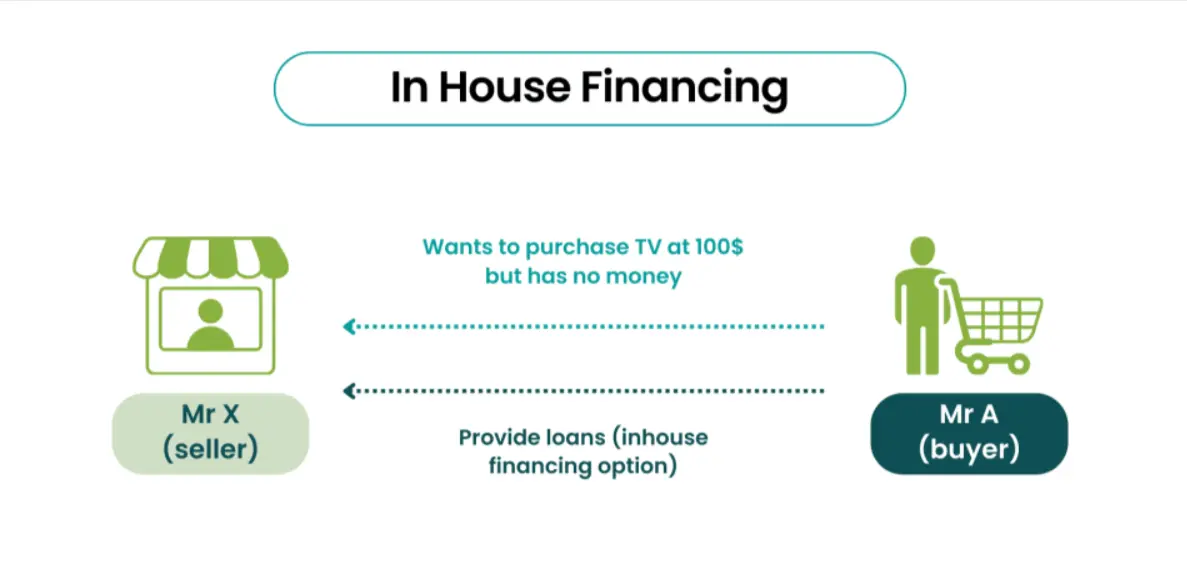

In house financing, also called seller financing or direct lending, is when a business offers a loan directly to a customer to purchase its products or services. Unlike traditional loans, where you borrow from a bank or credit union, the seller acts as the lender.

For example, a car dealership might offer you a loan to buy a vehicle, and you’d make payments directly to them. This cuts out the middleman, making the process faster and often more accessible. It’s a popular option for people who struggle to qualify for conventional loans due to poor credit or limited financial history.

How Does It Work?

The process is straightforward. You apply for financing with the seller, who reviews your financial situation—often with less stringent criteria than banks. If approved, you agree on payment terms, like monthly or weekly installments, interest rates, and the loan duration.

Once you sign the contract, you make payments directly to the seller until the loan is paid off. There’s no third-party lender involved, which means the seller has more control over the terms and can tailor them to your needs. For instance, a furniture store might let you pay $50 a week for a new sofa instead of requiring a lump sum.

Industries That Use In House Financing

In house financing isn’t limited to one sector—it’s a versatile model used across various industries:

-

Automotive: Buy here pay here (BHPH) dealerships offer loans to buyers with poor credit.

-

Real Estate: Homeowners or developers provide seller financing to buyers who can’t secure mortgages.

-

Retail: Furniture and appliance stores often offer payment plans for big-ticket items.

-

Healthcare: Dental clinics or medical practices provide financing for treatments like braces or surgeries.

Each industry adapts in house financing to suit its customers, making it a powerful tool for affordability.

Benefits of In House Financing

Accessibility for Consumers

One of the biggest perks of in house financing is its accessibility. Traditional lenders often require high credit scores, steady income, and extensive documentation. If you’ve got a low credit score or a thin credit file, those doors might be closed.

In house financing opens them. Sellers often have more lenient requirements, focusing on your ability to make payments rather than your credit history. According to the Consumer Financial Protection Bureau, millions of Americans with subprime credit rely on alternative financing like in-house loans to purchase vehicles or homes. This makes it a lifeline for those rebuilding their financial lives.

Flexibility in Terms

Unlike rigid bank loans, in house financing offers flexible payment plans. Sellers can customize terms to fit your budget, such as lower down payments, extended repayment periods, or even interest-free periods.

For example, a furniture store might offer a “12 months same as cash” deal, where you pay no interest if you settle the balance within a year. This flexibility lets you afford big purchases without straining your finances. It’s a win-win: you get the product, and the seller secures a sale.

Benefits for Businesses

For businesses, in house financing is a powerful sales tool. By offering loans, they attract customers who might otherwise walk away due to financing barriers. This can boost sales volume significantly, especially in competitive markets like automotive or retail.

Sellers also earn extra revenue through interest or financing fees, which can lead to higher profit margins. Plus, offering personalized financing builds trust and loyalty, encouraging repeat business. A 2024 study by McKinsey found that businesses with in house financing saw a 15% increase in customer retention compared to those relying on third-party lenders.

Environmental and Social Impact

In house financing isn’t just about cars or couches—it’s also driving sustainability. In the green technology sector, companies like solar panel providers use in house financing to make eco-friendly products more affordable.

A 2023 study from SpringerOpen noted that green financing models, including in-house plans, have increased solar adoption by 20% in underserved communities. By spreading out costs, these plans make it easier for households to invest in energy-saving solutions, reducing carbon footprints and supporting environmental goals.

Risks and Challenges of In House Financing

Higher Interest Rates

While in house financing is accessible, it often comes with a catch: higher interest rates. Sellers take on more risk by lending to buyers with poor credit, so they may charge rates well above those of traditional loans.

For example, a 2025 report from Bankrate found that buy here pay here car loans average 15-20% interest, compared to 5-7% for bank auto loans. Over time, these rates can significantly increase the total cost of your purchase. Always compare rates before signing to ensure you’re getting a fair deal.

Risk of Default for Consumers

Missing payments on an in-house loan can have serious consequences. In the automotive world, for instance, defaulting on a buy here pay here loan often leads to repossession of the vehicle. In real estate, you could lose the property and any equity built.

To avoid default, read the contract carefully. Look for details on late fees, grace periods, and what happens if you miss a payment. The Securities and Exchange Commission emphasizes the importance of transparent loan agreements to protect consumers from surprises.

Business Risks

Sellers offering in house financing face their own challenges. If too many buyers default, the business could suffer significant financial losses. Small businesses, in particular, may struggle to absorb these losses without robust cash reserves.

To mitigate risk, sellers need solid credit assessment processes. Some use fintech tools to evaluate buyers’ repayment ability, but not all have access to such technology. A 2024 Forbes article highlighted that 30% of small businesses offering in house financing reported default rates above 10%, underscoring the need for careful planning.

Regulatory and Ethical Concerns

In house financing operates in a less regulated space than traditional lending, which can lead to ethical issues. Some sellers may engage in predatory lending, charging exorbitant rates or hiding unfavorable terms in fine print.

Consumer protection laws, like those enforced by the Federal Trade Commission, aim to curb these practices, but enforcement varies. A 2023 OECD report on financial inclusion stressed the need for stronger regulations to ensure fair lending. As a consumer, always verify the seller’s reputation and read reviews before committing.

In House Financing in Practice: Case Studies

Automotive Industry: Buy Here Pay Here Dealerships

Buy here pay here (BHPH) dealerships are a prime example of in house financing. These dealers sell cars and provide loans directly, catering to buyers with bad credit. Approvals are often quick, and you can drive off the lot the same day.

However, BHPH loans typically carry high interest rates and strict repayment terms. A 2025 study by the National Auto Dealers Association found that 60% of BHPH customers paid rates above 15%. Despite the cost, these dealerships fill a gap for millions who can’t access traditional auto loans.

Real Estate: Seller Financing

In real estate, seller financing lets homeowners act as lenders, offering loans to buyers who struggle to qualify for mortgages. This is common in competitive markets or when buyers have unique financial situations.

For example, a seller might finance a $300,000 home with a 10% down payment and monthly installments at 6% interest. Benefits include faster closings and flexible terms, but buyers must ensure they can afford payments to avoid foreclosure. WordStream’s 2024 real estate trends report noted a 25% rise in seller-financed home sales since 2022.

Green Technology: Solar Panel Financing

In house financing is transforming the green tech sector. Solar companies like Sunrun offer payment plans to make panels affordable, often with no upfront cost. This spreads payments over 10-20 years, aligning with energy savings.

A 2023 SpringerOpen study found that in house financing boosted solar adoption in low-income areas by 20%, supporting both environmental and social equity goals. It’s a clear example of how financing can drive positive change.

Read More About: Stimulus Check 2025 – Key Payment Dates & How to Claim Fast

Tips for Consumers and Businesses

For Consumers

In house financing can be a great option, but it requires caution:

-

Read the Fine Print: Understand interest rates, payment schedules, and penalties for late payments.

-

Compare Options: Check if a bank loan or credit card might offer better terms.

-

Budget Wisely: Ensure payments fit your monthly budget to avoid default.

Financial planning is key. Use tools like budgeting apps to track expenses and stay on top of payments.

For Businesses

If you’re a business considering in house financing:

-

Adopt Fair Practices: Transparent terms build trust and reduce regulatory risks.

-

Leverage Technology: Fintech tools can streamline credit checks and payment tracking.

-

Monitor Defaults: Set clear policies for handling late payments or repossessions.

A 2024 Financial Innovation study found that businesses using fintech for in house financing reduced default rates by 12%. Invest in systems that protect your bottom line.

Staying Informed

Financial literacy is crucial for both consumers and businesses. Follow reputable finance blogs like NerdWallet or Investopedia for updates on lending trends. Stay aware of regulatory changes, such as new consumer protection laws, to make informed decisions.

in house financingis a powerful tool that makes big purchases accessible and boosts business sales. From buy here pay here car lots to solar panel payment plans, it offers flexibility that traditional loans often can’t match. But it’s not without risks—higher interest rates and the potential for default require careful consideration.

For consumers, in house financing can be a lifeline, but only if you understand the terms and plan your finances. For businesses, it’s a way to attract customers and build loyalty, provided you manage risks wisely. By staying informed and prioritizing financial literacy, you can make in house financingwork for you.

Ready to explore in house financing? Compare options, read contracts, and take control of your financial future.